A post by Giulio Galdi

In the last post on this blog, Simone Borghesi discussed the consequences of the COVID19 crisis, beyond the immediate reduction in worldwide pollution. Among them, he hinted at the challenge now facing all Emissions Trading Systems (ETSs). As production fell dramatically in the last weeks, allowances prices fell accordingly. In those carbon markets where price floors for allowances exist, they were hit. For the EU ETS, no floor is in place and the price of European Union Allowances (EUAs) went as low as the market forces drove them, after what seemed a rather solid positive trend.

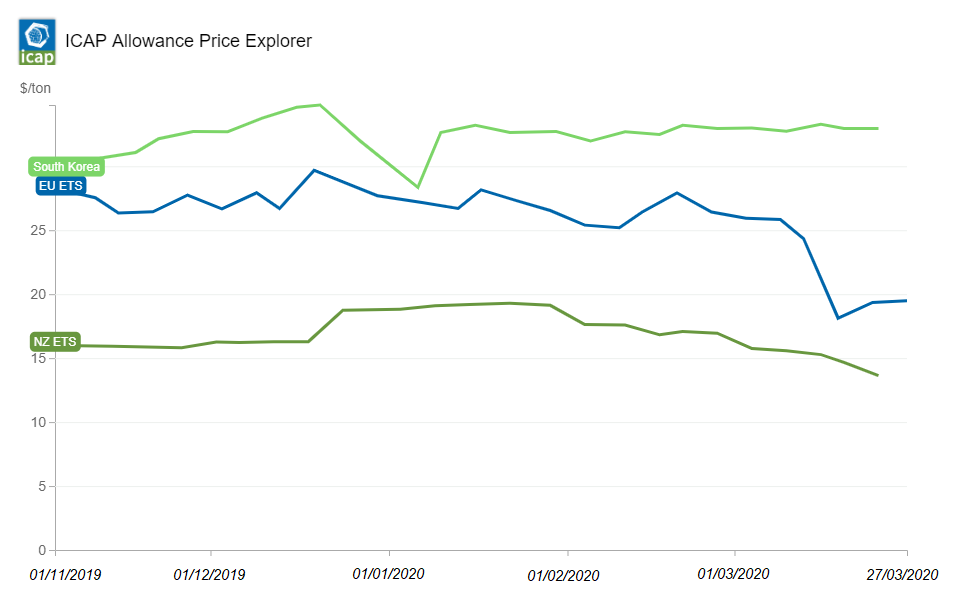

From the pre-COVID €25-27 levels, the EUA price is currently around €21, but hit a €14.40 minimum on 23/03 as prospects of a European lockdown hovered over industrial production. During this time, EEX temporarily closed its platforms for insufficient number of bids. As can be seen in the graph above, carbon markets whose jurisdictions were more effective in containing the contagion, e.g. New Zealand and South Korea, suffered lower impacts from the COVID crisis. A complete recovery in all markets would still need healthy and functioning economies across the globalised world. In Europe, EUA prices rose again as soon as Italy, the first European country to be hit by the COVID crisis, reached its plateau in the count of infected on the first week of April and as all EU countries made their pledge to help production to recover. However, the wide range covered by EUA prices the past few weeks prompts (at least) a couple of questions: 1) how does (will) the Market Stability Reserve (MSR) perform in countering this demand shock?; 2) is the MSR, in its current design, a sufficient mechanism for addressing a sudden allowance oversupply?

A relevant preliminary issue is understanding whether EUA prices will resume their pre-COVID upward trend or they will be further struck by future lockdowns and slow recovery of industrial production. Analysts tend to agree that the initial selloff of allowances is to be traced back mainly to the need of firms to raise cash to face the more immediate effects of the COVID-19 crisis. Market analysts also seem to agree that, as production resumes, the 2020 average price of EUAs should be somewhere between €16 and €25, with the notable exception of IHS Markit analysts, who warn that prices might break the historical €5 floor if the sanitary crisis extends beyond 2020.

The MSR will absorb a share of the excess supply of allowances generated by the fall in production, but it will do so only from 2022 and it might take years to drain the oversupply generated by the COVID-19, due to the two-years lag of the MSR’s response. For this reason, several market analysts are pushing for the implementation of a more responsive price control measure to prevent EUA prices from falling. This could be achieved by introducing a price floor in addition to the MSR or by substituting the quantity-based triggers of the MSR with price-based ones. However, would a price support really avoid a shrinking in new investments in emissions abatement technologies, during the pandemic? On the one hand, as the prospects for the industrial production recovery still look uncertain, firms would plausibly stall their investments until the pandemic retreats and they can make safer assessments on their returns. Furthermore, introducing a stronger price support could increase regulatory uncertainty, that is the risk firms perceive of unexpected changes to the carbon market regulation. A very rapid process of reform could work towards a worsening of this perception and affect investments in the long run.

On the other hand, a more responsive measure such as a carbon price support or a carbon floor could counterbalance the short run effects of the fall of allowance prices that are already playing out. First, the lower carbon price affected returns from past investments in low carbon technologies and could stall future investments due to increased uncertainty on returns. Second, a low allowance price temporarily boosts profits from coal and brown power, postponing an economic phase-out of dirtier fossil fuels. Firms deciding their investments based on current carbon prices could choose relatively more carbon-intensive alternatives, trapping themselves in a carbon lock-in. Finally, low allowance prices mean lower revenues from auctioning of allowances and thus a lower budget for climate policies. Auctioning proceeds currently provide independent financing for European climate action and also helps to build national support for the EU ETS, since the funds are collected on a national basis. Arguably, a carbon price support would promptly counter these short run effects, whereas they may not be effectively countered by the MSR.

This is not to say that the MSR is not going to tackle any excess supply induced by the COVID-19 crisis. An unexpected fall in demand of allowances is precisely what the MSR was designed for. The reserve will absorb a share of the excess supply through its feeding rate, starting from 2022. A faster increase in the number of allowances withheld in the reserve could also prompt its cancellation feature to trigger sooner than expected, effectively curtailing the allowance cap. It is indeed a good time to assess whether this response will be sufficient to keep prices within a desirable range.

The views and opinions expressed in this post are solely those of the author(s) and do not reflect those of the editors of the blog of the project LIFE DICET.