A post by Isabella Alloisio

The Innovation Fund is a key funding instrument to deliver the EU’s economy-wide commitments (EU NDC) under the Paris Agreement, as well as to comply with the ambitious long-term objectives of the EU Green Deal to achieve climate neutrality by 2050. The EU Emissions Trading System (EU ETS) will provide revenues for the Innovation Fund from the auctioning of 450 million emission allowances in the period 2020 to 2030, in addition to the remaining funds from its predecessor NER300 programme. The Innovation Fund aims to create financial incentives for projects supporting innovative low-carbon technologies in all Member States from taking off to reaching the market with the aim to boost innovation and competitiveness and empower EU companies to become global technology leaders.

Will these financial incentives be enough to spur innovation in Europe? Without a substantial financial contribution to innovation in low-carbon technologies the Paris pledges and EU Green Deal targets would be very hard, if not impossible, to achieve. The Fund is expected to amount at about €10 billion (about ten times higher than what has been awarded under the NER300 programme), but the exact amount will depend on the carbon price that has to be high enough to drive green investments and disincentivize the use of carbon-intensive technologies. The World Bank considers a carbon price ranging from 50 to 100 USD per tCO2 by 2030 to be consistent with the temperature goals of the Paris Agreement. Today in the aftermath of the lockdowns due to COVID-19 pandemic the price of carbon is as low as 21€ (23 USD) per tCO2 (as of 27 May 2020), which means reduced revenues from the auctioning of emission allowances and by consequence lower incentives to invest in low carbon technologies.

The Innovation Fund is one of the world’s largest funding programmes for demonstration of innovative low-carbon technologies. It invests in highly innovative technologies, as well as cross-cutting projects that can lead to emissions savings across sectors, for example through business model innovation or industrial symbiosis. The Fund is focused on five technology priority areas: Innovative low-carbon technologies and processes in energy intensive industries; Innovative renewable energy generation; Energy storage; Carbon Capture and Utilisation (CCU); Construction and operation of Carbon Capture and Storage (CCS).

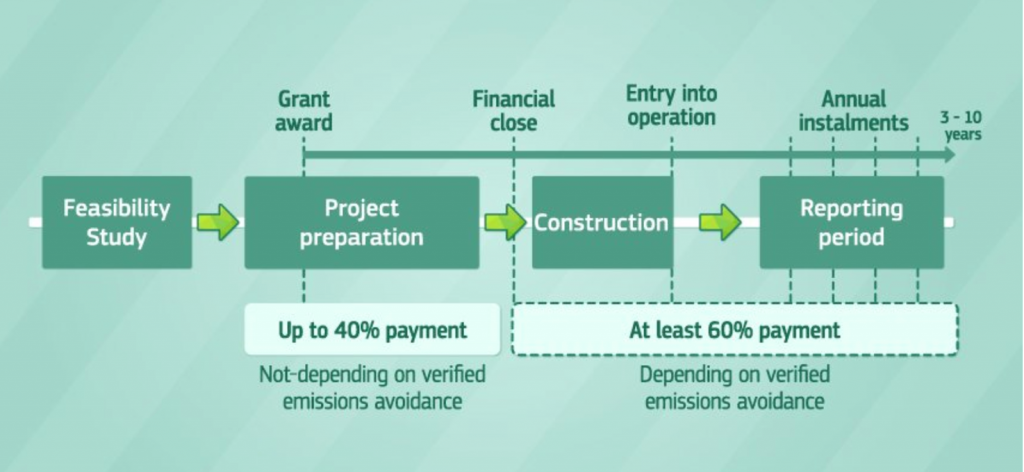

The Innovation Fund builds up from the NER300 experience but, unlike this, it covers more technologies (e.g. projects from energy intensive industries), and small-scale projects (capital costs below €7.5million) are eligible and benefit from a simplified selection process. With respect to NER300, the Innovation Fund improves the risk sharing approach supporting at least 60% of the additional capital and operational costs linked to innovation, and is more flexible since up to 40% of the grant can be awarded before the project is running and therefore not depending on verified greenhouse gases emissions avoidance (see figure below).

The focus of the Innovation Fund is on demonstration projects which need to be sufficiently mature in terms of planning, business model and financial and legal structure. It aims to finance a mixed project pipeline achieving an optimal balance of a wide range of innovative technologies. The application process has two phases: after the expression of interest, with a first assessment on the project effectiveness (of greenhouse gases emissions avoidance), the degree of innovation and maturity level, successful projects can start the full application where projects are assessed on all criteria, including scalability and cost efficiency (cost per unit of performance). The Commission aims to launch the first call in 2020, followed by regular calls until 2030.

One of the main strengths of the Innovation Fund is that it creates synergies with other EU funding programmes, such as the Modernisation Fund (addressed to the ten least wealthy Member States), the Cohesion Fund, Horizon Europe and InvestEU. The latter, also known as “Juncker plan”, is the EU’s flagship investment programme that in the framework of the European Commission proposal for a substantial recovery plan for post-Covid crisis (Next Generation EU) has been upgraded to €15 billion with the aim to mobilise private investments in projects across the EU. Other funds addressed to green investments have been created within Next Generation EU, namely: the new “Strategic Investment Facility” built into InvestEU to generate investments of up to €150 billion in boosting the resilience of strategic sectors linked to green transition, and the new “Solvency Support Instrument” which will be targeted at capital investments in EU companies in sectors, regions and countries most affected by the Covid-19 pandemic to unlock €300 billion in solvency support. Furthermore, a proposal to strengthen the “Just Transition Fund” has been made with additional €40 billion to assist Member States to accelerate ecologic transition.

The Innovation Fund is a promising instrument to deploy large-scale innovative projects and deliver the long-term goals of the Paris Agreement and of the EU Green Deal, however with the current price of carbon and reduced revenues from the auctioning of emission allowances the Fund might turn out to be insufficient to support the energy transition towards a EU economy with net-zero GHG emissions by 2050. However, in the framework of the Next Generation EU recovery plan, the synergy of the Innovation Fund with other EU funding instruments would be key for a sustainable EU post-Covid economic recovery.

The views and opinions expressed in this post are solely those of the author(s) and do not reflect those of the editors of the blog of the project LIFE DICET.