A post by Ottavio Quirico (Australian National University, University of New England and European University Institute)

Investment is essential to the implementation of the green economic transition outlined in the European Green Deal, in line with the Paris Agreement. However, international investment agreements, particularly the Energy Charter Treaty, protect carbon-neutral and carbon-intensive investment alike. This has spawned claims for compensation against policies that foster carbon-neutral investment, which are twice as much the amount of sustainable investment envisaged by the EU over the next ten years. Arguably, the only solution to this regulatory impasse is a reform of international investment agreements, particularly the Energy Charter Treaty, prioritising sustainable investment over unsustainable investment.

Investment is essential to the implementation of the green economic transition outlined in the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement. It is indeed at the core of the European Green Deal (EGD), which aims to mobilise at least €1 trillion in sustainable investments over the next decade. This raises the question whether international investment agreements, particularly the Energy Charter Treaty (ECT), are aligned with the target.

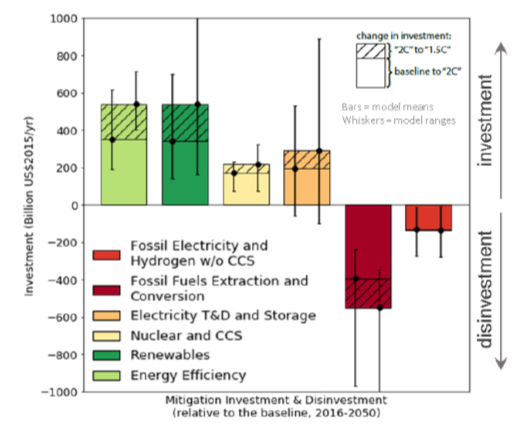

Article 2 of the Paris Agreement establishes that the parties aim to ‘strengthen the global response to the threat of climate change’ by, inter alia, ‘making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.’ This is fundamental to stabilising greenhouse gas (GHG) concentrations in the atmosphere and containing global average temperature increase well below 2°C, and possibly 1.5°C, above pre-industrial levels, according to the principle of common but differentiated responsibility. Reportedly, achieving carbon neutrality by 2050 involves a drastic reduction of investment in fossil fuel and a significant improvement of investment in renewables. The European Investment Bank has indeed announced the phasing out of support to energy projects reliant on unabated fossil fuel. However, according to the World Energy Outlook released by the International Energy Agency in 2021, the investment regime has not yet adequately integrated the need for such a radical green transition.

Within this regulatory framework, international investment agreements, particularly the ECT, protect carbon-intensive and carbon-neutral investment alike. The ECT aims to establish a level playing field for cross-border investment; for this purpose, the treaty regulates investment access to foreign markets and investment protection. The parties to the ECT have thus committed to making their best efforts to ensure freedom of investment transfer and fair and equitable treatment. More specifically, expropriation of foreign investment is only exceptionally allowed in the public interest and attracts full compensation, according to fair market value. On this basis, investors in fossil fuel have threatened or actually commenced action for compensation in international arbitral tribunals against States that implement carbon-neutral investment policies, as a form of indirect expropriation, which is reportedly worth €2.15 trillion, that is, more than twice the value of sustainable investment under the EGD over the next ten years. Aura Energy has put Sweden on notice of a claim for damages that amounts to €1.65 billion under the ECT for the 2018 amendment of the Environmental Code, which phases-out uranium prospection and exploration. RWE and UNIPER have commenced ICSID arbitration proceedings against the Netherlands for passing legislation (493/2019) that prohibits the use of coal in electricity production, in an effort to transition to clean energy sources, thus allegedly infringing investors’ legitimate expectations.

Prospectively, the EU and its Member States can address this stumbling block to the implementation of the EGD in different ways. First, there is the option of resigning from the ECT. Nonetheless, this would not immediately release the EU and its Member States from their investment obligations under the treaty, as ECT article 47 – the ‘sunset’ clause – extends the application of investment provisions under the treaty for twenty-one years from the notification of resignation, which is a major impediment to carbon-neutrality by 2050. Secondly, the EU and its Member States might argue that the ECT is terminated by climate change as a fundamental change of circumstances with respect to the initial aim of the treaty, according to article 62 of the overarching Vienna Conventions on the Law of Treaties. However, this would require evidence that climate change was an unforeseen circumstance when the parties signed the ECT in 1994. Thirdly, the EU and its Member States might seek to prioritise EU law over international investment agreements, particularly the ECT, so as to apply a regulatory regime that is more favourable to sustainable investment. This solution is nonetheless problematic under conflict of laws rules, with particular regard to the ECT, which is a mixed intra- and extra-EU convention and an international treaty on the same footing as the EU founding treaties. All these solutions would paradoxically jeopardise a treaty that was largely promoted and supported by the European Communities in the 1990s to facilitate cross-border energy exchange in the Eurasian context, within the framework of the 1991 European Energy Charter.

In light of the 2015 International Energy Charter, the only viable solution seems to be a greening of the ECT within the current process of modernisation, abandoning energy-source neutrality and prioritising low-carbon investment over carbon-intensive investment. This might go as far as to exclude investor-State disputes and compensation in the case of direct or indirect expropriation of carbon-intensive investment. The EU has tabled a proposal along these lines in the context of the ‘right to regulate’: negotiations are in progress.

To learn more about the issues investigated in this blog post, read the book:

- Quirico, O. (July 2021). Investment Governance between the Energy Charter Treaty and the European Union. Leiden, The Netherlands: Brill | Nijhoff. doi: https://doi.org/10.1163/9789004463431

The views and opinions expressed in this post are solely those of the author(s) and do not reflect those of the editors of the blog of the project LIFE DICET.